Investor’s Guide to Rental Properties: Costs, Insights, and Common Pitfalls

Are you considering purchasing a rental property in Alberta, British Columbia, or Ontario?

Buying a rental property isn’t just about the purchase price — the rules in each province can make a big difference to your returns. Here’s a clear side-by-side look at how things work in British Columbia (BC), Alberta (AB), and Ontario (ON).

Rent Control – how much can you raise the rent?

BC

Rent increases are capped once a year by the province (3% in 2025).

You can reset rent to market when a tenant moves out.

AB

No rent cap. You can raise rent as much as you want, but only once every 12 months per tenant, with proper notice.

No increases allowed during a fixed-term lease.

ON

Most units fall under the provincial cap (2.5% for 2025).

Big exception: properties first occupied after Nov 2018 are not capped — you can increase to market levels, but still only once every 12 months.

Like BC, rents reset to market when tenants leave.

👉 Takeaway: Alberta gives the most flexibility. Ontario’s “new build” exemption is very investor-friendly. BC and older Ontario properties are more restricted.

Eviction Rules – how easy is it to get your unit back?

BC

If you or a buyer want the unit for personal use: 4 months’ notice + 1 month’s rent paid to the tenant.

For major renovations or demolition: same 4 months’ notice + compensation.

Serious issues (like unpaid rent or damage) can mean shorter notice, but disputes often go through the Residential Tenancy Branch.

AB

Fastest timelines: non-payment can mean a 14-day notice, and extreme cases (violence/damage) allow 24 hours.

Ending for renovations is slower: 365 days’ notice required if it’s a periodic tenancy.

Fixed-term leases just end automatically on the end date.

ON

For landlord’s own use: 60 days’ notice + 1 month’s rent paid to the tenant.

Renovations have their own rules and forms.

“Good faith” is required — landlords must actually move in or do the renos, or face penalties.

👉 Takeaway: Alberta is the most flexible if you need to act quickly. BC and Ontario have longer timelines and compensation requirements.

Cost of Entry – what do closing costs look like?

BC

Property Transfer Tax: 1% on the first $200K, 2% up to $2M, 3% above $2M, plus 2% more if over $3M.

Extra 20% tax for foreign buyers in many urban areas.

Annual Speculation & Vacancy Tax applies if the property isn’t occupied (0.5% for Canadian owners, 2% for foreign owners).

AB

No land transfer tax!

Just small land title and mortgage registration fees.

ON

Land Transfer Tax (tiered rates).

In Toronto, you pay both the provincial tax and a municipal one — doubling the cost.

Foreign buyers pay a 25% Non-Resident Speculation Tax province-wide. In Toronto, there’s an extra 10% municipal foreign buyer tax on top.

👉 Takeaway: Alberta is the cheapest to buy into. Toronto is by far the most expensive when you stack provincial + city taxes.

How have prices performed in the various provinces and cities?

The first chart shows the appreciation based on a 10 year period for most of the provinces in Canada:

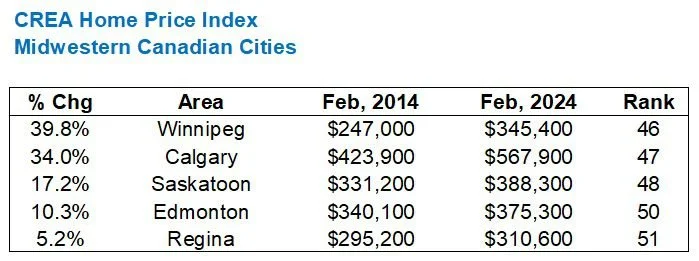

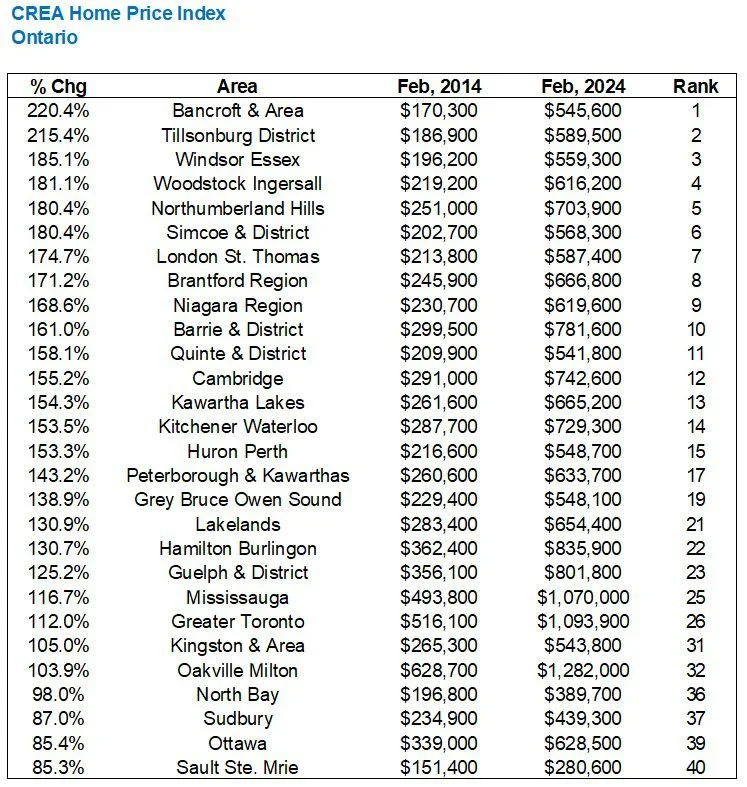

The following charts show the appreciation in prices in the various cities of some of the provinces:

Thinking about buying a new construction rental ?

Here’s a condensed comparison of buying new-construction rental property in BC, Alberta, and Ontario:

BC (British Columbia)

Vacancy/Demand: Very low (~1%), rents rising ~9%.

Rent Control: Annual cap (~3% in 2025), some new builds exempt.

Taxes/Incentives: PST & GST rebates for rentals; speculation/flipping taxes apply.

Pros: Strong demand, steady appreciation.

Cons: Strict regulations, limited rent flexibility.

Alberta

Vacancy/Demand: Higher (3–6%), strong but cooling rent growth.

Rent Control: None — landlords free to set rents (with notice).

Taxes/Incentives: GST rebate; no PST.

Pros: Low entry cost, full rent flexibility, landlord-friendly.

Cons: Oversupply risk, some pre-construction pitfalls.

Ontario

Vacancy/Demand: Tight (~1.5%), rents up ~8–9%.

Rent Control: Pre-2018 units capped; new builds exempt.

Taxes/Incentives: GST/HST rebate; some municipal incentives.

Pros: Strong demand, appreciation, rent control exemption for new builds.

Cons: High prices, slower eviction process, strong tenant protections.

Adjustments on Closing

When buying a new construction home or condo, it’s important to review your Agreement of Purchase and Sale. This section outlines the extra costs (known as adjustments) that you’ll need to pay in addition to your purchase price at closing.

Typical adjustments include:

Tarion Enrollment Fees – based on the purchase price.

Utility Hook-ups – installation and connection fees for water, hydro, and gas meters.

Development Levies – charges from the municipality to cover growth-related infrastructure.

Education Levies – contributions toward local school development.

Property Taxes – estimated annual property taxes plus a deposit toward future taxes.

Builder’s Legal Fees – such as mortgage discharge fees or real estate transaction levies.

HST on New Homes in Ontario

When you buy a new build in Ontario, you must pay 13% HST (resale homes are exempt).

The advertised purchase price already includes HST and assumes you qualify for the HST New Housing Rebate.

To qualify, you (or a close family member) must live in the home as your primary residence.

At closing, your lawyer will ask:

Primary Residence → no extra HST required.

Investment Property → you must pay back the rebate amount at closing.

👉 If you rent out the property under a 1-year+ lease, you can apply for the HST New Residential Rental Rebate after closing to recover some of the HST paid.

LINK TO HST RENTAL REBATE CALCULATOR

LINK TO PREVIOUS BLOG - Ontario’s New Residential Rental HST Rebate

What is Anti-Flipping?

Flipping = buying a property and selling it quickly (usually within a year or two) to make a profit.

Anti-flipping rules are tax measures that:

Prevent sellers from claiming special tax breaks (like the Principal Residence Exemption).

Ensure profits from quick sales are taxed more heavily, discouraging speculation.

Federal Rule (applies everywhere in Canada)

Effective Jan 1, 2023.

If you sell a residential property within 12 months, profits are automatically taxed as business income (100% taxable).

You cannot use the Principal Residence Exemption.

Exceptions for genuine life events: death, divorce, job loss/relocation, illness, safety concerns, etc.

📍 Provincial Variations

Ontario

No extra provincial flipping tax.

The federal 12-month rule is what applies.

British Columbia

Extra flipping tax starting Jan 1, 2025:

20% tax on profits if sold within 1 year.

Tax decreases after 1 year and disappears after 2 years.

Applies to both resales and assignment sales (pre-construction contracts).

Exemptions: life events, primary residence (with small deduction), some builder/developer cases.

Alberta

No provincial flipping tax.

The federal 12-month rule applies.

✅ Quick Summary

Everywhere in Canada: Sell within 12 months → profits = fully taxable business income (no capital gains benefit, no principal residence exemption).

BC: Stricter — adds its own flipping tax up to 20% if sold within 2 years.

Ontario & Alberta: Only the federal rule applies, no extra tax.

Did you know that if a resale home was previously used as an Airbnb, HST may apply when you buy it?

GST/HST Change-in-Use for Airbnb Rentals in Canada

Converting a long-term rental property to a short-term rental (like Airbnb) can trigger GST/HST liability under subsection 206(2) of the Excise Tax Act.

The rule deems the property repurchased at the time of the change, allowing ITC claims if GST/HST was paid—but resale properties usually have no GST/HST paid, so no ITCs are available.

Selling a property soon after using it for short-term rentals can result in unexpected GST/HST on the sale, as shown in 1351231 Ontario Inc. v. The King (2024), where a single year of Airbnb caused an $80,000 reassessment.

Landlords should seek expert GST/HST advice before converting properties to short-term rentals to avoid costly tax traps.