Navigating Uncertainty with Smart Financial Mortgage Strategies

Navigating Uncertainty with Smart Financial Strategies

As we near the midpoint of 2025, uncertainty continues to weigh on Canada’s economy. The effects of Donald Trump’s tariffs, rising inflation pushing interest rates higher, and instability in the job and housing markets are fueling widespread anxiety.

Let’s take a closer look at recent trends in sales volumes and prices across the GTA, GVA and Alberta:

Market Volume & Price Impact

🔹 GTA (Greater Toronto Area)

Sales volume: down 11% YoY

Prices: down 3.8% average, 4.5% benchmark

Active listings: up 42% → strong buyer’s market, prices softening

🔹 GVA (Greater Vancouver Area)

Sales volume: down 13.5% YoY

Prices: down 5.9% average

Rising inventory → downward pressure on prices

🔹 Alberta (province-wide)

Sales volume: down 8% YoY

Prices: up 4% YoY average

Calgary: sales down 17% YoY, prices up 0.4% YoY

Edmonton: sales up 9.5% MoM but still down YoY, prices rising modestly

Balanced supply supports stable-to-rising prices

Key takeaway:

GTA & GVA → Fewer sales + high inventory = prices declining

Alberta → Sales slower, but tight supply keeps prices steady or rising

Facing Higher Payments at Renewal? Here’s How to Ease the Hit

With today’s elevated interest rates, many homeowners are seeing mortgage payments jump by 30% or more at renewal, straining household budgets. Here’s how you can soften the blow:

✅ Extend your amortization – Resetting to 25 or 30 spreads your mortgage over a longer period, lowering monthly payments and easing cash flow pressure.

✅ Blend and extend – Some lenders let you blend your existing low rate with the new higher rate to create a weighted average, helping you avoid a sudden spike in payments.

✅ Consider temporary interest-only payments – Certain lenders offer short-term interest-only options, which can significantly reduce monthly obligations during challenging times (though this won’t pay down principal).

✅ Consolidate high-interest debt into your mortgage – Refinancing to roll in credit cards or lines of credit can replace higher-rate debt with your mortgage’s lower rate. This can improve cash flow and save you money on interest, since simply renewing without consolidating leaves you with a higher average debt rate overall.

Click the EFFECTIVE RATE CALCULATOR (ER = Effective Rate)

Two possible outcomes emerge:

If the existing mortgage rate (ER) is higher than the refinance rate, refinancing may generate savings based on the lower rate alone, in addition to benefits like improved cash flow. Consider using part of the increased cash flow to make lump-sum payments and pay down your debt faster.

If the existing mortgage rate (ER) is lower than the refinance rate, it’s usually better to renew the mortgage and pay down other debts separately, provided your cash flow can support it. Even though the refinance rate is higher, some individuals may still choose to refinance for cash flow management or other personal financial reasons.

Example Scenario

Client owns a home in BC valued at $800,000.

Current Debts:

Mortgage Renewal Balance: $300,000 at 3.99% for 5 years, amortized over 20 years.

Line of Credit: $60,000 at Prime + 3% (7.95%), with monthly payments of $1,000.

Credit Card Debt: $50,000 at 19.99%, with monthly payments of $900.

Debt Consolidation Proposal:

Refinance and consolidate all debts into a new mortgage of $410,000 at 4.19% for 5 years, amortized over either 25 or 20 years.

Options:

✅ Option 1: Renew Existing Mortgage

Mortgage payment: $1,811.19/month

Additional payments (LOC + credit cards): $1,900/month

Total monthly outlay: $3,711.19

Effective interest rate on total debt: 6.52%

Total debt: $410,000

✅ Option 2: Refinance & Consolidate at 4.19%

25-year amortization: $2,199.12/month

20-year amortization: $2,517.89/month

Estimated Annual Interest Savings:

Effective rate difference: 6.52% - 4.19% = 2.33%

Interest savings on $410,000: ~$9,555.95/year

Monthly Cash Flow Improvement:

On 25-year amortization: $3,711.19 - $2,199.12 = $1,512.07/month

On 20-year amortization: $3,711.19 - $2,517.89 = $1,193.30/month

Recommendation:

The client should choose the 20-year amortization refinance option. Although their monthly mortgage payment increases from $1,811.19 to $2,517.89 (an increase of $706.70), they still achieve a net cash flow improvement of $1,193.30/month by consolidating high-interest debts. The client is encouraged to use the improved cash flow to make lump-sum prepayments on the mortgage, accelerating debt repayment and saving more interest over time.

Should You Choose a Fixed or Variable Rate at Renewal?

With rates high and uncertainty about when they might come down, deciding between fixed and variable is crucial:

🔒 Fixed rates offer stability and predictable payments for a set term, protecting you if rates rise further. They’re ideal if you value certainty or worry about tighter budgets.

📉 Variable rates generally start lower than fixed, and could save you money if rates fall during your term—but they expose you to payment increases if rates rise. They’re better suited for borrowers with flexible budgets or shorter timelines.

Key consideration: Look at your personal risk tolerance, cash flow needs, and expectations for future rates. Sometimes a shorter-term fixed (e.g., 2-3 years) can give you stability now while letting you reassess sooner.

Bottom line: Renewal time doesn’t have to mean financial strain. By extending your amortization, blending rates, consolidating high-interest debt, and carefully weighing fixed vs. variable options, you can protect your budget and financial stability. Talk to a mortgage professional early to explore the best strategies for your situation.

Strategies to Minimize Mortgage Interest Costs:

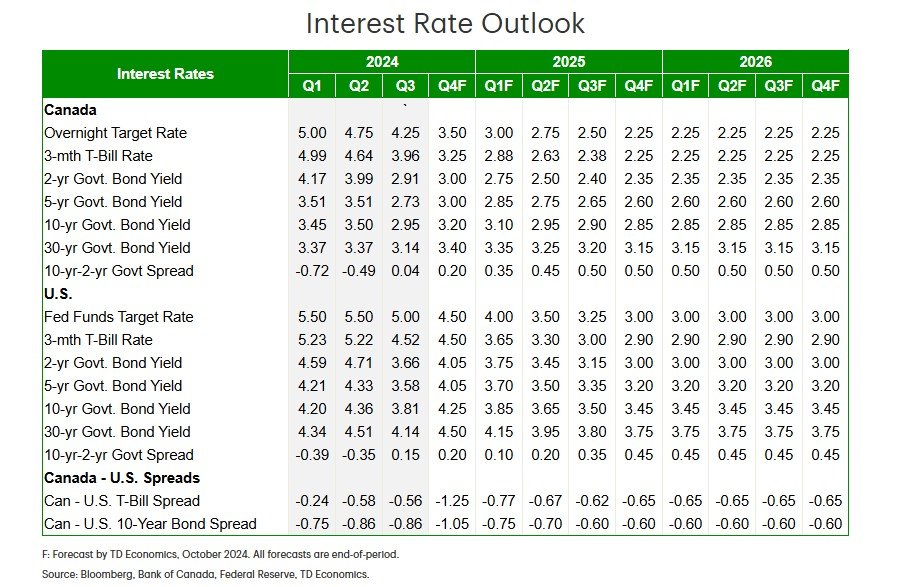

1. Choose a Variable Rate with Flexibility

Select a variable rate with a discount and the option to switch to a fixed rate. Interest rates may rise temporarily but are expected to decline between Q3 2025 and Q2 2026. You can lock into a fixed rate later or continue with the variable rate.

2. Choose a Short Fixed Term (3 Years)

Lock into a short-term fixed rate with the expectation of securing a lower rate when renewing. This strategy works if rates drop as projected. Some lenders allow you to opt into a new contract 6 months prior to renewal effectively lessening the term to 30 months.

3. Lock into a Longer Term with Flexibility

Choose a long-term fixed rate and explore options like blend-and-extend with certain lenders to lower your rate over time. Alternatively, work with lenders that offer reasonable penalties for breaking your mortgage if lower rates become available.

If you have any questions or would like to explore your mortgage options further, please feel free to reach out. We’re here to help you navigate the mortgage landscape!

The Smith Manoeuvre is a Canadian tax strategy that converts mortgage debt into tax-deductible investment loans. By re-borrowing paid-down mortgage principal to invest, homeowners gradually make their interest tax-deductible, potentially building wealth faster while maintaining a consistent mortgage payment. It requires discipline and carries investment risk.

Would you like to learn about the Smith Manoeuvre? Click below to obtain a free course on this powerful wealth-building tool : FREE COURSE AND INFORMATION