Fixing Affordability: Sustainable Strategies for Canada’s Housing Market

HOW LEGAL RENTAL UNITS CAN INCREASE MORTGAGE QUALIFICATION FOR THE CANADIAN HOMEBUYERS

For many Canadian homebuyers, adding a legal rental unit to their purchase strategy can significantly increase how much mortgage they can qualify for. With a traditional single-family home, qualification is based solely on the buyer’s income and existing obligations. However, when a property includes a legal suite, lenders can use rental income to strengthen the borrower’s ratios and increase their purchasing power.

Down payment requirements depend on the property type. For example, duplexes, owner-occupied buyers can put 5% down on the first $500,000 and 10% for the remainder. For an owner-occupied triplex or fourplex, the minimum down payment is 10% of the full purchase price. These rules make multi-unit properties an attractive option for buyers looking to offset living costs while building equity.

The treatment of rental income is where affordability improves the most. Many bank lenders include 50% to 85% of rental income while factoring in property taxes and heat. Many smaller group of lenders use 100% of rental income and remove taxes and heat from the calculation entirely—significantly boosting qualification. Because this income acts as a “mortgage helper,” the homeowner’s effective cost becomes the mortgage payment plus taxes, heat and insurance minus the rental income from the legal unit. A mortgage broker who understands these nuances and rules will make affordability a reality rather than a pipe dream.

To use this income, lenders typically require the suite to be legal, though some may accept legal non-conforming units that are grandfathered by the city. Market rent reports are usually acceptable even if the unit is not rented at the time of purchase.

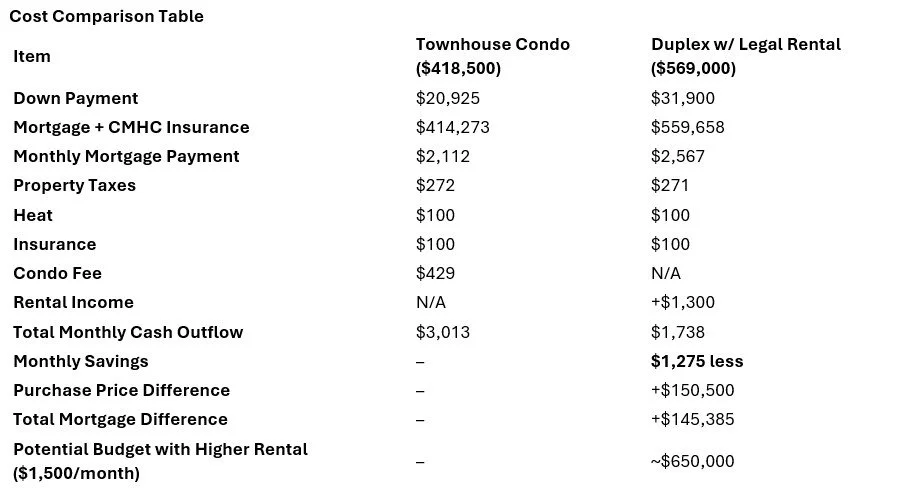

Here is an example of the effect of this rental income treatment:

Buying Power: Condo vs Duplex with Rental Income

Client Criteria (constant in both examples):

Income: $95,000/year

No monthly debts

First time home buyer eligible for a 30 year amortization

Funds available for down payment & closing costs: $41,000

Scenario 1 – Townhouse Condo in Barrie

Address: 11 – 244 Penetanguishene Road, Barrie (Georgian Drive), Ontario L4M7C2

Price: $418,500

MLS Listing: 11 – 244 Penetanguishene Road, Barrie

Scenario 2 – Duplex with Legal Basement Rental in Orillia

Address: 35 Argyle Avenue, Orillia, Ontario L3V2V5

Price: $569,000

Rental Income: $1,300/month

MLS Listing: 35 Argyle Avenue, Orillia

Key Takeaways (Expanded)

Rental income significantly reduces monthly cash outflow.

The duplex scenario shows a monthly savings of $1,275, meaning the client pays 57% less than they would for a condo.

Rental income boosts purchasing power.

The client can afford a home $150,500 more expensive, opening access to better neighborhoods and larger homes.

Higher mortgage qualification.

Rental income increases total mortgage potential from $414,273 to $559,658, giving the client access to higher-value properties without overextending.

Owner-occupied rental strategy works.

Rental income offsets monthly costs (mortgage, taxes, utilities, insurance).

With $1,500/month rental income, the client could potentially afford a $650,000 home, showing how scalable the strategy is.

Long-term wealth building.

Rental income helps pay down the mortgage faster, build equity, and creates passive income for the future.

Bottom line: A legal rental unit dramatically improves buying power, affordability, and long-term financial flexibility while allowing the client to live in the property

A friendly reminder: if at least one applicant is a first-time homebuyer, a 30-year amortization is permitted on a resale property. Additionally, even if the buyers are not first-time homebuyers, a 30-year amortization is still allowed on a high-ratio mortgage when purchasing a new construction home.

Canada’s Economic Outlook: Stability Ahead

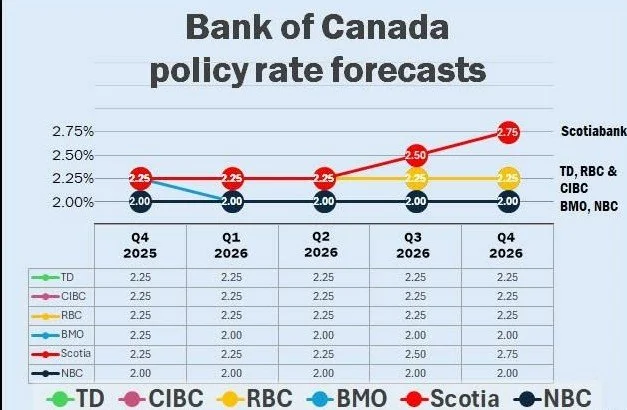

Major banks differ on the Bank of Canada’s next moves. TD, RBC, and CIBC expect the policy rate to hold at 2.25% through 2026, reflecting steady economic conditions. BMO and National Bank see room for one additional 25-basis-point cut, with National Bank suggesting it could happen as early as next month.

GDP growth is projected to be 1.2% in 2025 and 1.4% in 2026, supported by government spending and industrial investment, offsetting structural challenges such as weak productivity and slower population growth.

Scotiabank’s economists take a slightly more hawkish view, arguing that inflation pressures are strong enough that the BoC has likely finished cutting rates. They anticipate two 0.25% hikes in the second half of 2026, reflecting confidence in Canada’s resilient economy.